Increasing enmity between China and the West, stemming from China’s increasingly aggressive actions regarding Taiwan, China’s COVID-zero policy and a whole host of other issues, has caused foreign companies that do business in or with China to reassess. See Nancy Pelosi’s Visit to Taiwan is Really Bad for Your China Business and Sourcing Product From China Just Got Even Riskier.

With all that has been happening, the international manufacturing lawyers at my firm have been seeing an uptick in phone calls and emails from companies looking to leave China. Most of these companies want to know more about Mexico.

I asked my good friend Andrew Hupert to explain what is involved in moving manufacturing from China to Mexico, in large part by comparing the two countries. I chose Andrew for this near-Herculean task because he has spent so much time in both countries navigating their manufacturing systems from the inside. My law firm frequently consulted with Andrew when we first started doing China legal work in a big way and at that time Andrew was living in China. Though Andrew had for decades tied his life and career to China, like me, he was one of the early proponents of a post-China manufacturing world. So much so that Andrew moved to Mexico, reinvigorated his Spanish language skills and began helping companies — especially companies looking to leave China — navigate Mexico. Who better, then, to write about what it takes to leave China (in whole or in part) for Mexico than Andrew Hupert?

The below is part four of what will be a long-running series. This episode deals with negotiation tactics, which is something Andrew knows a lot about as he has taught many negotiation courses at leading business schools around the world.

Over to Andrew for Part 4 . . . .

Western managers with China experience know the challenges (and risks) that come with cross-border negotiations. Those considering a move to Mexico will have to navigate a new set of cultural adjustments.

1. End of the Story First

Chinese negotiators are known for being PATIENT PRAGMATISTS. They will wait as long as they have to for the right opportunity or resource. But when they feel a counterparty’s utility value is gone, they will turn to another opportunity — already under development. Mexican negotiators are DECISIVE but SKEPTICAL. They will assess you, assess your offer, and assess their environment before making a decision. The suddenness of their decision-making may seem jarring to you if you are accustomed to China — especially if the answer is a definite NO. In Mexico the ability to decide on a next step is the sign of leadership, unlike China where caution is often more highly valued.

The general vibe of the negotiating process is also different. Chinese negotiators want the process to move forward. They like negotiating — they see it as intrinsic to their identity as managers and as a basic leadership skill. Mexican negotiators usually don’t consider deal-making to be their main job. They want the negotiation over so they can get to work.

2. Analysis

Let’s dive down and take a look at three key differences U.S./Euro negotiators should keep in mind when working with counterparties from China and Mexico.

- Cultural profiles: Patience vs. decisiveness.

- History of the relationship. Ugly, but different.

- No! vs. It’s Difficult

A. The Cultural Profiles

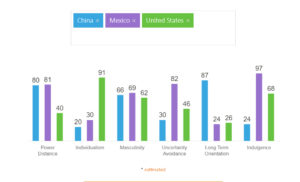

My main tool for analyzing cultures is “Hofstede 6 Dimension Cultural Comparison tool“. There are 6 dimensions of culture. Each culture is ranked based on their position between POLAR OPPOSITES.

- Power Distance (how do REGULAR people feel about wealth, power, and influence being distributed unequally?)

- Collectivism vs. Individualism (how team-oriented is society?)

- Masculine or Feminine (Live to work or work to live?)

- Uncertainty avoidance (are you OK with not knowing what will happen next?)

- Traditional vs. Pragmatic (long term orientation – do you fight the future or fit with the future?)

- Indulgence vs. Restraint (immediate pay-off vs. patience to wait for future benefits)

B. Mexico and China similarities

Both cultures like relationships and networks. China and Mexico both have high power distance and high collectivity scores. This means they both respect authority and are comfortable in group situations. To succeed with either culture you’ll have to work hard to build a relationship — but once you have established a connection it is usually valuable and long-term.

Masculinity scores are mildly high for both cultures, indicating they are both fairly aggressive, are oriented towards doing deals, and are somewhat competitive. These scores are all kind of “normal” and don’t reveal anything earth-shaking.

C. Mexico and China contrasts

Dimensions #4 & #6. Uncertainty Avoidance and Indulgence are keys to understanding the differences between Mexican and Chinese negotiators. Mexico scores a whopping 97 on the Indulgence dimension compared to an ultra-patient 24 for the Chinese. But wait, there’s more. Look at the Uncertainty Avoidance index to see how each culture feels about uncertainty, loose ends, and lack of clarity. Mexicans HATE this feeling and score a very high 86 here. I’ve been told that the reasons Mexicans are sensitive to uncertainty is that they feel they have very little control over their day-to-day life, so they are constantly afraid of new disruptions or difficulties. The Chinese side, however, is actually pretty “ok” with uncertainty. The result is that Mexican negotiators tend to be quite decisive and will make what seem like snap decisions to wrap up loose ends and “settle the matter”, even if it’s only settled briefly, and new difficulties crop up immediately. China’s default setting for relationship-building is to develop every potential relationship until there is a reason not to.

We also have to discuss the Long-Term Orientation index. LTO doesn’t mean patience or planning horizon; that’s the Indulgence index. LTO deals with how cultures relate to the past (tradition) and the future (pragmatic). Do you fight the future (“that’s not the we always did it/not the way my Dad did it/not the way God wants it done”) or try to fit in with the future (“I know we’re communists who distrust foreigners and hate landlords, but our grandchildren will be wealthier if they speak English and own property, so that’s what we’ll do”). China scores an extremely pragmatic 87 on this index; they are all about preparing for the future. Mexico (along with the U.S.) comes in at the other end of the scale with a very traditional 24, meaning that Mexican negotiators may need a lot of convincing before they agree to try something new.

D. Bad Histories – Different Attitudes

Negotiators from Europe and the U.S. are happy to leave the historical baggage at home when they negotiate across borders, and in the previous commercial environment our counterparties were willing to go along. See Globalism 2.0 is here. 5 Key Characteristics of the New World Order.

Now, however, some of the peskier elements of our history (Century of Humiliation, invading and annexing half their country, etc.) are popping up in conversations and on social media. In the old days, this didn’t much impact us. As long as we remembered to give our instructions SLOWLY and LOUDLY and didn’t jokingly threaten military action, we were good. Yes, in China we got better over time, but I was on a couple of company visits in the late 90s where the culture/knowledge gaps were astounding, on both sides.

Now, however, the anti-western/anti-U.S. propaganda in China is official, relentless, and ultimately effective. China, as we all know, was occupied and partitioned by the West and Japan during its “century of shame” (百年国耻 Bǎinián Guóchǐ ). We were all happy enough to forget about ancient history (1839 – 1949), but now it’s trending again. Chinese nationalism has become a threat to brands marketing to Chinese consumers, who are caught between a rock and a hard place. It difficult to maintain a China-friendly brand while complying with U.S./Euro policies (i.e., Sweden’s H&M boycotted in China for complying with Xinjiang cotton ban). As relations between China and the West continue to deteriorate, look for Western brands and manufacturers to suffer more.

In Mexico, the history isn’t much better, but the impact on your business couldn’t be more different. During a recent trip to Monterrey I visited the Museum of Noreste, where I learned that Saltillo (the Detroit of Mexico) was once the capital of the Mexican state of Coahuila and Tejas (modern Texas, Arizona and a big part of California), until 1835. Though the good folks in Dallas may not get particularly excited about this, Mexicans in the prosperous NW states of Coahuila, Nuevo León and Tamaulipas talk up their close connections with Texas.

Negotiators approaching Mexican counterparties should be prepared. The people across the table are likely to be conservative, religious (Catholic), and deal-driven. English-language media (even the commercial sites) gives a wildly distorted view of the average Mexican. Cartels, refugees, and all-inclusive resorts are NOT common topics of conversations in Mexico. Mexican manufacturers see themselves as part of the larger U.S. economy, and Mexican business culture is as aligned with the U.S. as possible. When you start a conversation in Mexico, don’t be surprised if they want to drill down to details right away. Mexican bosses want to do business with you, but they will not move too far out of their (commercial) comfort zones. Mexican negotiators will determine if you (and your product) are a good fit, and THEN start building a relationship. Focus on business – and leave the lurid headlines behind.

E. No! Versus It’s Difficult

Chinese negotiators have a well-deserved reputation for not wanting to give a direct NO. In Chinese, it often comes off as abrupt and impolite. Mexicans have no problem saying “no”. This is a downside to Mexican decisiveness. Mexicans tend to be skeptical about your intentions and commitment and will often err on the side of caution. Over the course of their history, Mexicans have frequently lost control over their own destiny. When a Mexican manager has the opportunity to make a decision, they will do it. If Mexican counterparties have doubts about your proposal, they are more likely to decline early than to explore long-shot possibilities.

This contrasts with Chinese negotiators, who place a higher value on relationships and networks. Chinese negotiators can be very patient about their own transactions, but they also feel that you may have value to other members of their network, so it’s worth keeping the relationship going. That’s why in China it’s common for negotiators to hear phrases like, “it’s difficult”, or “the timing isn’t right, but that may change”. It’s important for negotiators in China to be clear on time horizons and deadlines. In Mexico the danger is the quick NO, but in China you need to beware of the endless pause.

3. Conclusion

The biggest differences between Chinese and Mexican negotiators relate to timing and transparency. In China, it’s easy to start a relationship, but it may end up costing you considerable time and energy and yield nothing. In Mexico, your counterparty will qualify you and your deal quickly to decide if you are a legitimate counterparty in terms of your specifics AND their broader business environment. If the answer is NO, you’ll hear it early and definitively. If your deal makes sense and you seem like a committed partner, then the relationship-building process can begin. Both Mexican and Chinese negotiators want to end up in the same place — a cordial, profitable, long-term business relationship — but they take different (almost opposite) routes to get there. When approaching Mexico, do your research, show up with good questions, and take the initiative to talk up your commitment to the deal.

Andrew Hupert lives and works in Mexico where he helps international businesses get their supply chains under control. After over 20 years in Asia (Shanghai, Taipei, HK, Saigon), Andrew decided to follow his own advice and move his operations closer to home. He is now based in Saltillo, Coahuila, the ‘Detroit of Mexico’, where he shows companies how to expand or adjust their supply chains for 2023 and beyond. He sums up his new effort very simply: “Bosses that don’t control their supply chains and sourcing don’t control their own business.” Contact Andrew Hupert to talk about the future of your supply chain: Andrew@JLAsociados.com.mx , or connect on LinkedIn.