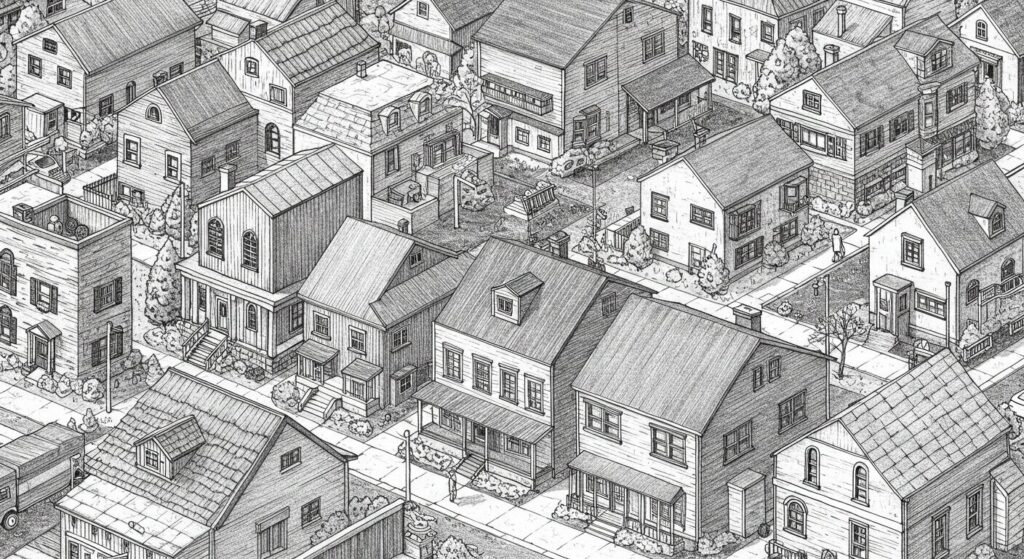

Hidden Costs of HOA Living: What Every Homebuyer Should Know

Thinking about buying a home in an HOA community? Condos and townhomes often provide an affordable alternative to single-family houses—along with perks like pools, fitness centers, and landscaping. But before you sign on the dotted line, there’s one major factor that can make or break your homeownership experience: the HOA.

Homeowners Associations (HOAs) manage many residential communities, ensuring shared spaces remain attractive and well-maintained. However, they also impose fees, enforce rules, and sometimes levy costly special assessments that can catch unsuspecting buyers off guard. Without proper due diligence, what seems like a dream home can quickly become a financial burden.

What Is an HOA and Why Does It Matter?

An HOA is a governing body made up of homeowners who enforce community rules and oversee maintenance of common areas. Many buyers view HOAs positively, as they help maintain property values and ensure a uniform appearance within the neighborhood. However, these organizations also wield significant financial and regulatory power over homeowners.

While an HOA can require only minor rules—such as mandating wooden fences—it can also enforce stricter regulations, like limiting the number of potted plants on your front porch or requiring all curtains visible from the outside to be white. More concerning than aesthetic rules, however, is the financial responsibility that comes with HOA membership. Monthly dues and special assessments can increase suddenly and significantly, sometimes pushing homeowners into unexpected financial hardship.

HOA Rules and Fees: The Fine Print You Can’t Ignore

Consider this real-life example:

A retired client of my law firm purchased a condominium with a $1410 monthly HOA fee, well within her budget. She had planned carefully, ensuring she could afford both the mortgage and HOA dues on her fixed income. However, just two months after moving in, she was blindsided by a special assessment for exterior repairs, which more than doubled her HOA fee to $3,060 per month.

Trapped in a financial bind, she had no choice but to sue the previous owner for failing to disclose the assessment. The legal battle dragged on for months, costing her even more in attorney’s fees—an outcome she never expected when buying what she thought was her dream home.

This is not an uncommon situation. HOA assessments can quickly become overwhelming, and homeowners often don’t realize their true obligations until it’s too late.

How to Protect Yourself from Costly HOA Surprises

Before purchasing a home in an HOA-managed community, due diligence is essential. Here’s how to protect yourself from unexpected fees, legal headaches, and financial risks:

1. Review the Title Report & CC&Rs

The Covenants, Conditions, and Restrictions (CC&Rs) outline the HOA’s rules. Carefully review these documents to ensure you can comply with all restrictions. These documents can be obtained from the HOA management company or from the county recorder’s office.

HOA rules can limit your lifestyle choices—from the color of your front door to whether you can park in your own driveway. Make sure you’re comfortable with these rules before committing to the purchase.

2. Request Full HOA Fee & Assessment History

Ask the seller and the HOA for a breakdown of all past fees, special assessments, and projected increases. This will help you identify patterns of excessive charges.

When requesting this information, ask for a written statement from the HOA detailing all past assessments in the last five years and whether any new ones are being considered.

3. Check for Upcoming Special Assessments

Major community repairs—like replacing roofs, repaving roads, or fixing drainage issues—can trigger costly special assessments. Request meeting minutes from the last 12 months to identify discussions about upcoming projects.

A key question to ask: “Are there any planned or potential special assessments in the next 12 to 24 months?” If the HOA hesitates or avoids answering, consider that a red flag.

4. Confirm Reserve Fund Health

A well-funded HOA should have enough reserves to cover routine maintenance and unforeseen expenses. If reserves are low, homeowners are more likely to face sudden, high-cost special assessments.

Ask for the most recent reserve study—a financial report detailing the HOA’s future funding needs—to assess the association’s financial health.

5. Consult a Real Estate Attorney

HOA laws and contracts can be complex, and special assessments can lead to costly disputes. Consult with a real estate attorney to understand your rights and obligations under your state’s HOA laws. They can review the CC&Rs, financial disclosures, and HOA policies to help you avoid potential legal and financial pitfalls.

State-Specific HOA Laws

HOA regulations vary by state, with some states offering stronger consumer protections than others. Here’s an overview of HOA laws in California, Oregon, and Washington:

1. California

- California has extensive legislation governing HOAs, including the Davis-Stirling Common Interest Development Act, which provides detailed rules on HOA governance, financial management, and dispute resolution.

- Homebuyers have strong disclosure rights regarding HOA documents and potential assessments.

- California courts often handle HOA disputes through mediation or arbitration before litigation.

- If you’re buying in California, you have some of the strongest consumer protections in the country—use them to your advantage by demanding full disclosure.

2. Oregon

- Oregon’s Planned Community Act and Condominium Act regulate HOAs.

- The state emphasizes dispute resolution through mediation and provides specific guidelines for HOA operations and financial responsibilities.

- Oregon law also covers disclosure requirements for sellers, ensuring buyers receive accurate HOA information before purchasing.

- Oregon’s emphasis on mediation can help resolve disputes faster, but don’t assume the HOA will always be on your side. Get everything in writing.

3. Washington

- Washington’s Condominium Act and Homeowners’ Association Act govern HOAs.

- The laws address issues such as HOA powers, financial management, and member rights.

- Washington requires sellers to disclose known upcoming special assessments to potential buyers.

- Homebuyers in Washington should take extra care to review seller disclosures, as state law requires sellers to disclose upcoming special assessments.

Final Thoughts: The Benefits and Risks of an HOA

HOAs can offer numerous benefits, including well-maintained community spaces, consistent property values, and access to shared amenities like pools and gyms. However, they also come with financial risks and regulatory obligations.

A well-managed HOA can enhance your quality of life, while a mismanaged one can drain your finances. The key is preparation: Ask the tough questions, demand transparency, and consult professionals before making a commitment.

HOA laws vary from state to state, so it is important to check your local state laws regarding HOAs. The right home in the right HOA can be a great investment—just make sure it’s one you can truly afford.