No one can be told what the Matrix is.

Similarly vexing, if perhaps somewhat less adaptable to the big screen, is telling someone what an NFT is. It ends up being easier to start with what it is not.

An NFT is not cryptocurrency. Currency, crypto or otherwise, must be fungible. For any monetary system to function, one dollar has to be the same as any other dollar, like one bitcoin has to be the same as any other bitcoin, at least as to objective indicia of value. NFTs, on the other hand, being nonfungible tokens, clearly are not interchangeable like money.

While NFTs typically are associated with artwork, video clips or low-fi illustrations, buying an NFT does not necessarily transfer IP rights to its purchaser. The most popular and expensive NFTs, however, do tend to permit the NFT’s owner to commercialize the copyrights associated with the NFT’s underlying content. In such cases, these rights “run with” the NFT, meaning they are rights incident to ownership, much as a lake easement might run with a nearby home.

Maybe the most pervasive type of NFT is called a “PFP,” a digital profile picture purchasers can flaunt on social media. Although there are any number of notable examples of single edition, “one of one” works of digital art selling as NFTs for millions of dollars, including through international auction houses like Sotheby’s and Christies, the PFP “collection” is the more intriguing model from a legal and cultural point of view. Owners purchase one or more PFPs from a themed collection of individual NFTs that quite often numbers in the thousands (10,000 is something of an aspirational standard for would-be NFT juggernauts).

NFTs from a new collection are “minted” by their new owners on a blockchain, typically Ethereum, but also maybe BLUR or perhaps Solana, as they are purchased, in what is called a “drop.” In this model, each NFT in the collection exhibits some combination of a host of traits or attributes spread across the group of NFTs. For example, each of the 10,000 PFPs in “blue chip” NFT collection CryptoPunks exhibits a unique combination of 87 unique attributes like hats, jewelry, beards or cigarettes.

A rare, ape-themed CryptoPunk (24 out of 10,000, or .00024%), with a hat, an earring, and an eye patch — #6915 — sold on September 5, 2024, for just about $1.5 million. Earlier this year, #6915 had been the subject of offers in excess of $5 million. By some estimates, the overall NFT market has seen a similarly steep decline in excess of 75% from its highest sales numbers of the year, when in March 2024, monthly volume was about $1.6 billion.

CryptoPunks’ IP rights are owned by Yuga Labs, which is also the owner and creator of Bored Ape Yacht Club and Mutant Ape Yacht Club. Together, these 3 NFT collections owned by Yuga accounted for about $28 million in trading volume in September 2024, between 5- and 10-percent of the total market — down from their performance in previous months.

In terms of dollars per month, as of August 2024, the most active NFT “exchange” in today’s post-FTX landscape is called Magic Eden, with a trading volume of roughly $123 million in August, or about 37% of the month’s total NFT sales of approximately $375 million. The next most active NFT exchange is called Blur, which had an August 2024 sales volume of $84 million—a 25% share of the total monthly market. OpenSea was August’s third most active exchange with a 19% or $67 million share of the month’s trading volume. Over the past year, these 3 exchanges have jockeyed with each other for spots on the podium, while collectively controlling at least 80% of the overall NFT market.

Given OpenSea’s visibility, not only as a top NFT exchange, but also as a cornerstone of the ambitions of the very-bullish-on-Web3 venture capitalists at Andreesen Horowitz aka a16z, it is unsurprising that August 2024 was also the month in which the SEC issued OpenSea a Wells notice, the formal agency notification that an investigation has been completed and infractions found. It’s basically a proper invitation to an upcoming SEC enforcement action against you and/or your company.

The SEC has been on a tear in terms of NFT investigations, enforcement actions and litigation. In 2023, the SEC brought a number of enforcement actions, including against two popular companies offering NFTs—what the agency referred to as “crypto asset securities”—to the public: Impact Theory and Stoner Cats 2. Impact Theory was fined over $6 million, while Stoner Cats was fined $1 million. Both companies agreed to destroy unsold NFTs and create Fair Funds for the benefit of purchasers wishing to recoup their investments.

OpenSea simply is a more recent and visible target, one that is better equipped to fight back and not afraid to say so. The company marked the occasion of receiving the SEC’s Wells notice by announcing it was putting up $5 million to pay legal costs “for NFT creators and devs who receive a Wells notice.” Still, it’s far from clear whether that fight will be partially or wholly successful, notwithstanding OpenSea’s VC money and defiant rejection of the SEC’s claims. As detailed further below, some might say a16z, respected thought-leaders though some of their folks are, is too twisted up in the crypto, NFT, and Web3 space to protest too much.

In the SEC’s ongoing effort to bring NFTs within its ambit, the agency has relied on the influential decision of the U.S. Supreme Court in the 1946 case SEC v. W.J. Howie Co., which established a test for identifying an “investment contract” subject to the registration requirements of the Securities Act of 1933. Howie involved the sale of plots of Florida land, mostly to nonresidents of Florida. In an arrangement that may as well have inspired the classic play and film Glengarry Glenn Ross, the plots of land were marketed as prime property for orange-growing. The new owners were pitched by an affiliate of the land seller to sign ten-year service agreements for the cultivation, harvest and sale of the oranges, with net profits allocated to the landowners on a pro-rata basis. Eighty-five percent of the owners signed such service contracts, which, notably, could not be cancelled.

Reasoning that the buyers were people “who reside in distant localities and who lack the equipment and experience requisite to the cultivation, harvesting, and marketing of the citrus products,” the Court concluded the buyers have “no desire to occupy the land, or to develop it themselves; they are attracted solely by the prospects of a return on their investment.” As such, the proposed land sale/service contract bundle was deemed an investment contract, making it a violation of the Securities Act to offer the opportunity to the public without SEC registration.

The test announced in Howie has become the standard by which NFTs and cryptocurrency are measured by the SEC and courts. The Howie test is a four-factor test, though for our purposes, the first factor—requiring the investment of money—is a given. The other 3 factors require that the investment of money to be (i) in a common enterprise; (ii) with the expectation of profits; and (iii) derived primarily through the efforts of others.

In the Stoner Cats 2 matter, the SEC alleged that that the issuer of the NFTs, a company owned by Mila Kunis and Ashton Kutcher, violated the Securities Act by selling unregistered Stoner Cat NFTs, the proceeds of which were intended to fund the development of an animated series and other media projects, all of which would create profits that would flow through to the individual NFT owners. Buyers were encouraged to see themselves as investors in the project, with the potential to benefit financially from the show’s success. In support of its view of the Stoner Cats NFTs as investments in a common enterprise with the expectation of profit, the SEC highlighted marketing language used in the promotional materials, which suggested that the tokens would become more valuable as the series gained traction and popularity.

There is no spoon.

Ownership of a Stoner Cats NFT did not allow an individual owner to make any commercial use whatsoever of the NFT artwork or its connection to the larger Stoner cats ecosystem. In fact, many NFTs available on Magic Eden, OpenSea and elsewhere, even some of the top collections by monthly trading volume, similarly restrict the commercial rights available to NFT owners. Stoner Cats’ Terms of Service (“SC Terms”) reflect this restrictive approach, even though they start out sounding like a pretty good deal:

Your purchase of a Stoner Cats NFT means you have full ownership rights in the Stoner Cats NFT, including the right to store, sell and transfer your NFT. However, you acknowledge and agree that your purchase of the Stoner Cats NFT does not provide any rights, express or implied, in (including, without limitation, any copyrights or other intellectual property rights in or to) the Stoner Cat associated with the NFT other than a limited license…for your own personal, non-commercial use and in connection with a proposed sale or transfer of the Stoner Cats NFT. For the avoidance of doubt, you do not have the right to distribute, or otherwise commercialize your Stoner Cat or any Digital Content without our explicit prior written authorization.

The SEC decided the value of the NFTs was entirely dependent on the successful “efforts of others,” in this case the famous creators, in producing, promoting, and distributing the animated series. NFT holders were not generating value through their own actions but were relying on the creators to make the series a success and increase the value of the NFTs. Without the efforts of the creators and producers of the show, the SEC argued, the NFTs would not appreciate in value, making it impossible to create any meaningful secondary market for the Stoner Cats NFTs, a market the creators explicitly envisioned and promoted.

In June 2024, Dapper Labs, another NFT company using essentially the same model, settled a federal class action for selling allegedly unregistered securities by paying $4 million into a settlement fund. Through a co-venture with the NBA called Top Shots, Dapper obtained a license to use game footage, player likenesses and other NBA content to create a series of NFTs called “Moments.” Like Stoner Cats and many other NFTs, however, Dapper Labs prohibited the NFT owners from any sort of commercial use.

The Dapper Labs Terms of Use for NBA Top Shots (“DL Terms”) sound a lot like those of Stoner Cats:

For the sake of clarity, you understand and agree: (a) that your purchase of a Moment, whether via the App or otherwise, does not give you any rights or licenses in or to the App Materials (including, without limitation, our copyright in and to the associated Art) other than those expressly contained in these Terms; (b) that you do not have the right, except as otherwise set forth in these Terms, to reproduce, distribute, or otherwise commercialize any elements of the App Materials (including, without limitation, any Art) without our prior written consent in each case, which consent we may withhold in our sole and absolute discretion.

Having sucked the NFT dry of all monetization potential, the DL Terms leave the NFT owner with “a worldwide, non-exclusive, non-transferable, royalty-free license to use, copy, and display the Art for your Purchased Moments, solely for…your own personal, non-commercial use” or “as part of a marketplace that permits the purchase and sale of your Purchased Moments.”

In other words, you can make it your profile picture, or you can sell it, but don’t you dare try to make any money from your ownership of the NFT.

It is not hard to see why the judge in the Southern District of New York denied Dapper Labs’ Motion to Dismiss in 2023, a ruling that no doubt catalyzed the settlement process. “When a person purchases a Moment,” the court wrote, the owner does not acquire any rights to the basketball highlight depicted by the NFT or the underlying artwork or other intellectual property.”

The court found that a common enterprise existed because Dapper Labs maintained centralized control over the proprietary Flow blockchain where the NFTs were issued and traded. Dapper Labs controlled all aspects of the marketplace, from the minting of NFTs to their trading on secondary markets. Dapper Labs’ focus on the resale market and the rarity of specific Moments encouraged buyers to view the NFTs as investment opportunities, rather than merely as collectibles. The court also found that buyers of Moments were relying on Dapper Labs’ ongoing efforts, emphasizing that without an active marketplace or infrastructure to support ongoing trading there would be no way to drive demand and liquidity for the NFTs. Notably, included as conditions of court approval of the settlement, Dapper Labs had to commit to the court that it would allow the Flow blockchain to be independently managed by a third party and allow other NFT exchanges to trade in NBA Top Shot Moments.

In my view, Stoner Cats, Impact Theory and NBA Top Shots, and the thousands of other NFTs out there using the same model, remain open to attack by the SEC for as long as they continue to centralize ownership of the NFT IP and limit its commercial use to the creator, or “issuer,” of the NFTs. When the issuer owns and controls all valuable IP associated with a NFT collection, and there is any kind of secondary market for the NFTs, the SEC should be expected to argue under Howie that the NFTs are “investment contracts,” where the purchasers are investing in a common enterprise and relying principally on the efforts of others to make a profit.

Yuga Labs takes the opposite approach to licensing IP rights to its NFT owners, what Edward Lee refers to as “decentralized Disney” in his book Creators Take Control. Lee provides a long list of commercial businesses formed by individual Ape NFT owners, based on their particular Ape or Apes, ranging from Ape-themed beer, wine and coffee to books, podcasts and clothing. Eminem and Snoop Dogg collaborated on a release based on their Apes, while Major League Soccer signed a promotional contract with an Ape to becomes the league’s first “virtual player.”

The BAYC Terms & Conditions (“BAYC Terms”) outline the specific rights that NFT holders receive upon purchase:

When you purchase an NFT, you own the underlying Bored Ape, the Art, completely. Ownership of the NFT is mediated entirely by the Smart Contract and the Ethereum Network: at no point may we seize, freeze, or otherwise modify the ownership of any Bored Ape.

Additionally, the BAYC Terms grant broad commercial rights to owners:

You have an unlimited, worldwide license to use, copy, and display the purchased Art for the purpose of creating derivative works based upon the Art (“Commercial Use”). Examples of such Commercial Use would be the use of the Art to produce and sell merchandise products (T-Shirts, etc.) displaying copies of the Art.

This contract effectively gives NFT owners the right to monetize their Bored Apes in any commercial form, provided that the use does not violate specific prohibitions, e.g., hate speech or defamation. As one might expect with a property right, even an intangible one, when the NFT is sold, the commercial rights transfer to the new owner, and the original holder no longer retains those rights.

When YUGA acquired the IP rights to the CryptoPunks NFT collection, it reversed course on the more restrictive licensing regime it inherited. Initially, the CryptoPunks Terms and Conditions (“CP Terms”) provided for a “non-exclusive, royalty-free license to use, copy, and display the Art for your purchased CryptoPunk” for your own “personal, non-commercial use.”

Now, the CP Terms are aligned with the BAYC Terms:

We are giving full commercial rights to CryptoPunks holders, allowing them to use their Punks in the same ways that Bored Ape Yacht Club holders can use their Apes.

In this way, the BAYC and CP Terms offer the broadest rights possible under a non-exclusive license: giving NFT holders full economic rights, short of transferring copyright ownership.

The right to make and sell derivative works based on an NFT you own should make the NFT less likely to qualify as an investment contract. An owner of a Bored Ape or CryptoPunk does not need to rely on the efforts of the NFT issuer to nearly the same extent as would an owner of a Stoner Cat or NBA Top Shot Moment to drive appreciation of the NFT’s value on the secondary market. Broad grants of commercialization rights as exemplified in the BAYC and current CP Terms are a way to refute arguments under Howie that purchasers are investing in a common enterprise where the value of the NFT will be primarily driven by others.

There is a difference between knowing the path and walking the path.

You would be forgiven at this point in concluding that Yuga Labs, with its permissive, “decentralized Disney” IP-licensing model, is free from SEC scrutiny and positioned to lead the larger NFT marketplace into a grand unregulated future.

Not quite, as the SEC has reportedly been investigating Yuga Labs for over two years. Not, mind you, for anything to do with decentralized IP rights, but rather because of what Zachary Small calls “recentralization,” in his book Token Supremacy. In this instance, the recentralization takes the form of Yuga deciding to (i) launch its own flavor of crypto; (ii) dole a ton of it out to insiders and investors; and (iii) then sell it to the public based on the promise of some kind of burgeoning, tokenized Yuga ecosystem.

Following Yuga Labs’ acquisition of CryptoPunks, the company announced the issuance of ApeCoin ($APE), a proprietary cryptocurrency marketed as “a token for culture, gaming, and commerce,” and designed to serve as the native token for the broader BAYC ecosystem. At the time, Yuga Labs tweeted, “We’re adopting ApeCoin as the primary token for the Bored Ape Yacht Club ecosystem and future Yuga products.” Within days of ApeCoin’s launch, over 94 million tokens had been claimed and major cryptocurrency exchanges like Coinbase had listed the tokens, allowing them to be traded on the open market, where they plummeted from short-term heights of roughly $27 in early 2022 to a current value below $1 USD.

While the tokens were officially released by ApeCoin DAO, a decentralized autonomous organization, the close relationship between the ApeCoin, the DAO and Yuga Labs has raised concerns among critics. ApeCoin was initially distributed (or “airdropped”) to holders of BAYC and other related NFTs. Significant token allocations also were made to “launch contributors,” including venture capital firm Andreessen Horowitz (a16z), which invested $450 million in Yuga Labs, a week after ApeCoin’s debut. Along with allocations to Yuga Labs itself, these insiders owned a quarter of the issued and outstanding tokens.

While the project is marketed as decentralized and community-driven, the reality of this token distribution model is that the initial NFT holders, Yuga Labs, and their VC backers hold a seemingly unassailable control position within the DAO, as voting power is tied directly to the number of tokens held.

In a deservedly oft-cited interview with Bloomberg, crypto investor Aaron Brown described the ApeCoin DAO “a placeholder attempt to capture future potential business under the Bored Ape brand name.” It’s kind of like a Special Purpose Acquisition Company (“SPAC”), he says, with “money raised today for some possible business to be named later,” but “without the legal protections around real SPACs.” Investors in “real SPACs” get enhanced disclosures (including of conflicts of interest), explicit redemption rights and strict liability for principal executives and directors for material misrepresentations or omissions in any registration statement.

Although YUGA has always retained the rights to the trademarks of its NFT collections, a decision to continue tightly controlling those rights and denying them to owners would fit nicely in an SEC recentralization argument based on ApeCoin and the DAO, because I can start a restaurant and brewery based on my Apes, but I better watch myself if I publicize it as a “Bored Apes production.” In an admittedly somewhat extreme recent case, Yuga enforced its trademark rights in federal court against a “conceptual artist” who had been selling what the court held to be confusingly similar “copies” of BAYC content from domain names and websites that were also confusingly similar. In response to defendants’ arguments that their copies were “appropriation art” protected by the First Amendment, the judge found the copies were “no more artistic than the sale of a counterfeit handbag.”

I can only show you the door. You have to open it.

In The Crypto Legal Handbook, Justin Wales recounts the story of a crypto client who sought advice from an expensive, experienced securities lawyer about the proposed launch of a new token (an “ICO,” or Initial Coin Offering, as they used to say in a more exuberant, less regulated time, i.e., 4 years ago). The old pro assured the client “there’s nothing new under the sun,” including crypto. After months of work and a $50,000 bill, the client had a lengthy legal memorandum explaining how he needed to acquire a number of state money transmitter licenses at a cost of perhaps a million dollars. Because the old pro did not understand the distinction between a self-custodial wallet and a custodial exchange wallet, however, all of his advice was off base and essentially useless.

I quote Wales’s prescription for not becoming that guy at length, because I credit his advice for girding me to dive into the deep end:

[T]he best way to learn is to set aside an amount of money you are okay writing off as an educational expense and start purchasing digital assets, sending transactions, and interacting with different protocols and the communities that support them. Try to get a feel for what is possible and an opinion on whether there is anything to all this crypto stuff in the first place.

Okay, consider it done. Here is how it unfolded.

I read up on digital wallets and chose Phantom over the more popular MetaMask because Phantom has better exchange rates (there are numerous other options, besides). Phantom will hold my cryptocurrency and NFTs in a self-custodial wallet, which only I will have the credentials necessary to open. Because I forget and change passwords multiple times a day—which is not possible here—this prompted me to cut and paste the credentials to a few different locations on my devices, to reduce the chances of quickly losing access to my own digital assets.

Though I was fretting for a moment about connecting my bank account to the crypto world, I bit the bullet and acquired, for about $150, a single Solana token. I picked Solana (SOL) in part because I had seen it mentioned a number of times, including in Michael Lewis’s Going Infinite as a token factoring significantly in the FTX collapse and bankruptcy. Beyond that, I wanted to buy a “whole” token, though this concept does not make much sense in a fractionalized, tokenized world, as I would soon realize.

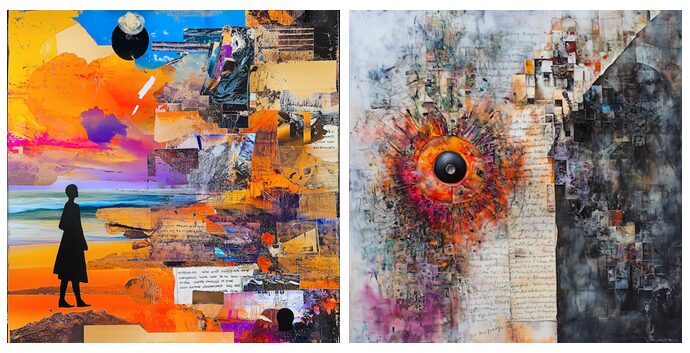

I discovered that most NFTs on exchanges like OpenSea, Foundation and Magic Eden are listed in ETH, which was trading at around 1 ETH = $2,400 at the time. I tried to buy 0.1 ETH for about $240, the same way I bought the SOL, but my bank account was flagged and I could not continue. I actually thought this was a good sign, in that some adult, somewhere, seemed to be trying to prevent theft and fraud, which made the existentially challenging notion of a decentralized everything seem a little bit less decentralized. While waiting to hear from customer service about my bank account, I decided to create actual NFTs based on my own AI-assisted artwork and offer them for sale.

Inspired by notions of being a multimillionaire NFT phenomenon like I’ve read about recently, I got to work.

My bank account cleared and I purchased .01 ETH. I minted 5 or 6 NFTs on OpenSea and listed them for sale. To mint an NFT costs money, which most blockchains refer to as “gas.” I found that I could mint an NFT and list it for sale for about $5-6 in ETH if I got the timing right. At times of more extreme network congestion, the same minting and listing of a single NFT could cost as much as $10-15 or more. These amounts are deducted from your wallet as you mint, list or buy things. Generally, this technology is pretty respectable, but it is not yet totally ready for primetime. From getting a wallet, connecting your bank account, and buying crypto, to minting NFTs, listing them for sale and transacting with the larger community, the whole thing takes a minute to figure out.

And then all my NFTs disappeared from my account. I had named my collection “Paroxyms,” a totally random word I have never used before. As it turns out, a “bad actor” had been trying to defraud people on OpenSea with content called “Paroxyms,” in a way customer service did not explain, so my NFTs had been made temporarily invisible thanks to some internal OpenSea filtering. (Incidentally, I have so far experienced superb customer service, mostly through chat, related to my bank account and buying crypto and to the trials and tribulations of my NFT minting antics with OpenSea. Again, not everything can be decentralized—and that can be a good thing.)

With my NFT collection secure, I set out once again to make sense of this brave new world, until some of my NFTs disappeared from my collection. Again. Desperation setting in, I examined my “collected” NFTs vs. “created” NFTs. One view shows you all the NFTs you have created, not surprisingly, while the other shows the NFTs in your collection, i.e., the ones you own, regardless of who created them.

And that is when I realized it. Someone had purchased 4 of my first series of NFTs, for a total of .04 ETH, or about $100. OMFG. At the outset, I did not fully understand how NFTs worked. Now, I am actively listing a growing portfolio of NFTs on multiple blockchains and have my first sales behind me. I am obviously still a real newbie given that I could not tell the difference between a successful sale and fraud. I also need to take my own advice, if I want to create some kind of buzz, and create a large batch of PFPs that take advantage of tokenization, with a unified theme and a host of traits of varying degrees of scarcity to promote collectability.

One concept I am working on is a fun PFP themed around Bigfoot. We’ve reviewed how with PFPs, someone mints an NFT in the series and pays for it—before knowing exactly what mix of traits, and hence, how rare, the buyer’s new NFT is within that particular PFP universe.

Another idea I am developing is a series of NFTs depicting sculptures yet to be made, where the NFT would come with the rights to actually make, display and sell the sculpture in the physical world.

Fasten your seatbelt, Dorothy.

In 2017, when one bitcoin was worth about $5,000, Nobel Laureate economist Robert Shiller was asked if he considered it a speculative bubble. Quoting his own definition of a bubble, from his 2005 book Irrational Exuberance, Shiller described

a situation in which news of price increases spurs investor enthusiasm, which spreads…from person to person, in the process amplifying stories that might justify the price increases, and bringing in a larger and larger class of investors who, despite doubts about the real value of an investment, are drawn to it partly by envy of others’ successes and partly through a gamblers’ excitement.

So, yeah, it’s a bubble, Shiller said, both “in 2013 in the original flush of excitement for Bitcoin, and then, after a temporary collapse in Bitcoin value,” again in 2017.

These first couple of bitcoin bubbles happened 5 years before the “crypto winter” of 2022 that took down FTX and supposedly marked the beginning of the true end of crypto, NFTs and blockchain. But as Shiller points out, these speculative bubbles may be inaptly named, in that “soap bubbles burst once and for all,” while speculative bubbles do not. “Gold itself,” he said, is merely “a sequence of speculative bubbles, starting in ancient times, and still continuing after thousands of years.”

As I write these final words of this piece, BTC trades at $68,187.03 — an almost 1,300% increase over the quaint $5,000 price that “burst” the 2017 “bubble” — the one that preceded FTX and the crypto- and NFT-bubbles of the pandemic years, the bursting of which purportedly wiped the value of everything blockchain out of existence.