The Pig-Butchering Scam, also known as Sha Zhu Pan (杀猪盘), Crypto Romance Scam, CryptoRom, or Hybrid Investment Romance Scam, is a deceptive and harmful scheme that preys on individuals on dating apps and social media. Scammers patiently build trust with their targets over weeks or even months, luring them into fake investment opportunities in cryptocurrency, forex, gold, or other assets.

How the Scam Works

- Connection and Grooming: Scammers strike up conversations on dating apps or social media, building a false sense of friendship or romance. They may use fake profiles and personas to appear more convincing.

- Investment Introduction: After gaining trust, the scammer gradually introduces the idea of investing in a seemingly lucrative opportunity. They might claim to have insider knowledge or expertise in the market.

- Fake Platforms and Pressure: Victims are directed to fake investment websites or apps controlled by the scammer. These platforms often show manipulated results, creating the illusion of guaranteed profits. The scammer, often posing as customer service, uses various tactics to pressure victims into investing increasing amounts of money.

Common tactics include:

- Guaranteed returns: Promising unrealistic gains with little to no risk.

- Limited time offers: Creating a sense of urgency to pressure quick decisions.

- Social proof: Fabricating fake testimonials or endorsements.

- Guilt and isolation: Making victims feel responsible for missed opportunities or using emotional manipulation to keep them invested.

To describe these scams as a major problem is an understatement:

- Federal Trade Commission (FTC) Reports: The FTC has noted a significant rise in romance scams, which includes investment scams like the Pig-Butchering Scam. In 2021, losses to romance scams reached a record $304 million in the United States alone, reflecting a nearly 50% increase from 2019.

- FBI Internet Crime Complaint Center (IC3): The IC3’s annual report highlights the growing problem of internet-enabled theft, fraud, and exploitation, with financial losses from various internet crimes reaching billions of dollars annually. Though the report covers a broad range of internet scams, it notes that investment scams have been particularly lucrative for fraudsters.

- Global Impact: In Asia, Europe, and Australia, authorities have reported a surge in investment scams, with victims losing millions to schemes promising high returns on investments in cryptocurrencies, forex, and other assets. Countries like Singapore, Hong Kong, and Australia have issued public warnings about the rise in investment scams.

- Cryptocurrency Scams: The use of cryptocurrency in these scams has compounded the problem, with the anonymous nature of crypto transactions often making it harder to trace and recover funds. Billions of dollars have been lost in crypto-related scams, including those involving investment schemes. In addition to the original scam involving bitcoin, many individuals have come to us after having paid large sums to “fraud recovery services” and/or “bitcoin tracking companies” that took the money and did literally nothing but scam the victims a second time. We see these second scams on nearly half of the internet fraud cases we take on.

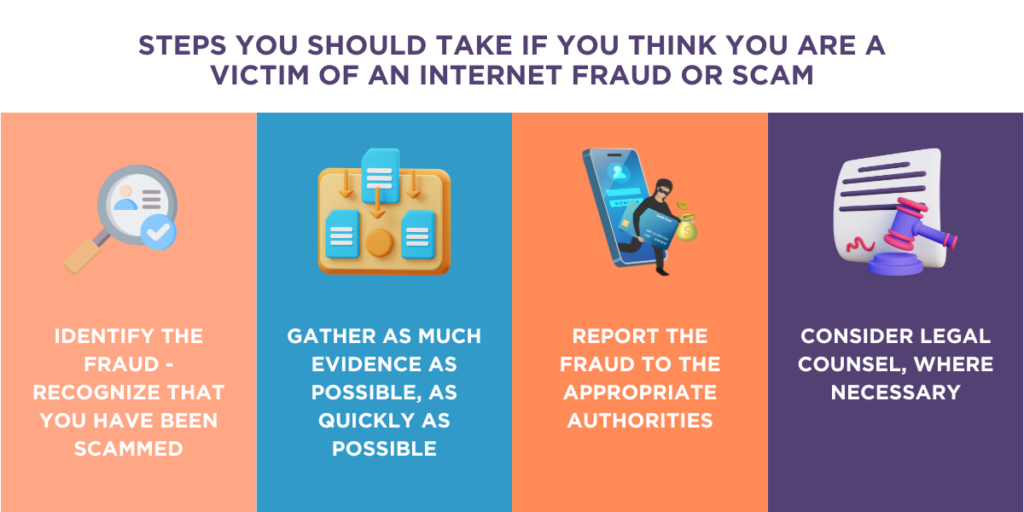

Steps You Should Take if You Think Are a Victim of An Internet Fraud or Scam

In this post, I discuss the steps you should take if you think you are a victim of an internet fraud or scam.

Identify the Fraud:

The first step in dealing with internet fraud is to recognize that you have been scammed or even that you might have been scammed. Look for unusual activities such as unauthorized transactions on your bank accounts or credit cards, suspicious emails or messages asking for personal information, or unexpected changes to your online accounts.

The big indicators are often that the company holding your money is not giving you the money you seek to withdraw from them and/or seeking money from you for taxes to get it.

If something seems off, trust your instincts, and investigate further. Vigilance is key.

Gather Evidence:

When you suspect internet fraud, it is imperative you gather as much evidence as possible, as quicky as possible. Take screenshots and print out any relevant communications, including emails, text messages, or social media conversations. Keep records of any transactions or payments made, including receipts and invoices. These pieces of evidence will be valuable when reporting the fraud and potentially when working with your attorney. Do not give any hints to the party that you suspect them of fraud or that you are seeking to gather more information regarding their operations.

Report the Fraud:

As soon as you realize you’ve been a victim of internet fraud, report the incident to the appropriate authorities. Contact local law enforcement agency and file a police report. Additionally, report the fraud to your bank or credit card company, letting them know about the unauthorized activity and requesting that they freeze your accounts or cards to prevent further losses. Be diligent in following up with these entities to ensure that appropriate action is taken.

When to Hire an Attorney:

While reporting the fraud to the authorities and financial institutions is crucial, there may be situations where hiring a lawyer is necessary to protect your rights and seek compensation. Consider consulting with a lawyer if:

- The fraud involves a significant amount of money or assets.

- The fraud is part of a larger scheme or organized criminal activity.

- Your case involves cross-border jurisdiction, making it complex to navigate legal systems.

- You have suffered substantial emotional distress or reputational harm from the fraud.

- You believe the authorities are not taking appropriate action in your case.

Internet fraud can be a distressing experience, but knowing the right steps to take can help mitigate the damage and protect your rights. By promptly reporting the fraud, gathering evidence, and considering legal counsel, where necessary, you can increase the likelihood of recovering your losses and holding the perpetrators accountable. Remember, prevention is key, so stay vigilant, educate yourself, and take proactive measures to protect yourself from falling victim to internet fraud.

Remember:

- If someone you barely know pressures you to invest, it’s a scam.

- Never share your financial information or invest on unfamiliar platforms.

- Be wary of promises of guaranteed returns or limited time offers.

- If something feels wrong, trust your gut and break off communication. But do not tell the scammer that you have broken off communication because your lawyers may want you to recommence communication with your scammer to gather more information or to buy time while investigating.

Protect yourself:

- Be cautious about who you connect with online.

- Never share personal or financial information with strangers.

- Research any investment opportunity thoroughly before committing.

- If you suspect a scam, report it to the authorities.

Spread awareness:

- Share this information with your friends and family to help them avoid falling victim to this scam.

By staying informed and vigilant, you can protect yourself from the Pig-Butchering Scam and other online investment frauds.

February 6 Update: An attorney friend send me a very helpful list put out by the Michigan Attorney General’s office on what to look out for to avoid being scammed and what you can do to protect yourself:

Look for red flags:

- Strangers sending seemingly innocuous text messages out of the blue.

- Strangers who quickly try to move the conversation to WhatsApp or another social media site.

- People who avoid video-calling with multiple excuses or flatly refuse to initiate any kind of video-calling.

- People chit-chatting about their insider investment knowledge.

- The URL of the investment platform doesn’t match the official website of a popular cryptocurrency market or exchange but may be very similar.

- The investment app generates warnings of being “untrusted” when launched, or the computer’s antivirus software marks it as potentially dangerous.

- The investment opportunity sounds too good to be true.

Follow these tips to protect yourself:

- Don’t send money, trade, or invest with a person you have only met online.

- Don’t speak of your financial position or investments.

- Don’t share personal information or current financial status with strangers.

- Don’t provide your banking information, social security number, copies of your identification or passport, or any other sensitive information to anyone online or to a site that you cannot verify is authentic.

- If an online investment or trading site promotes unbelievable profits, it is most likely just that—unbelievable.

- Be cautious of individuals who claim to have exclusive investment opportunities and urge you to act fast.