1. Omicron and Your Supply Chain

Omicron is incredibly contagious and China is not well-equipped to slow it down to the same extent it has done with previous COVID variants. Omicron will likely lead to shutdowns of China’s factories and convince more product buying companies to diversify out of China.

A loyal reader emailed me over the weekend asking if we would write about Omicron and supply chains. They said this January 27, 2020, post, China’s Coronavirus and Your Supply Chain: Dealing with Unknowns and False Diversification (only nine days after the first COVID case was detected in the United States) had helped them at the beginning of COVID and they were hoping we would do another such one on Omicron. This is that post.

2. China’s COVID history is a good indicator of its Omicron future

I wrote that January 27, 2020, post because so many “companies that do their manufacturing in Asia are [were] in turmoil right now” and I wanted to try to provide those companies with at least some actionable advice.

That 2020 post pulled extensively from an article by Renaud Anjoran, titled, What the Wuhan Virus Means for Importers of China Products. Renaud’s article listed out the following questions Renaud was getting about COVID and his answers to those questions:

1. Will workers come back? Many have returned to their hometowns for CNY. “They will probably wait longer before returning to work. If the situation gets worse, they might wait for months.” He calls the Wuhan area a special case and notes that factories whose management and/or the operators come mostly from that area “might not re-open.”

2. What will conditions be when production resumes? The Chinese government might impose new sanitary rules, especially in sectors like food and medical devices. “The government might postpone the opening of all offices and factories.” Even in the absence of Chinese government decisions, it will make sense to enforce certain rules like masks and gloves for all workers, regular disinfection of certain areas, etc. The governments of importing countries “might also impose strict rules for certain products” from China.

3. Will component suppliers keep delivering? “Your assembly suppliers might get back to work, but some factories in your supply chain might not re-open for several weeks . . . or ever. Be ready to look for new sources.”

4. Is it desirable and realistic to start manufacturing in another country, to reduce exposure to China? “

Many buyers are starting to think about this. Unfortunately, if you haven’t already taken a few steps in that direction (finding and qualifying suppliers, having them work on development and on a small order), it will take months.” If your orders are small and if you cannot pay a higher price, you will probably not find any good options in Vietnam, Thailand, or Indonesia. There has been a rush to those places from other buyers, and most manufacturers in those countries simply cannot take any more business.

5. Can we ship out the products that were completed before the Chinese New Year? Logistics should still function as usual in the next few weeks. This will probably not be a problem.

6. Will many factories NOT re-open after CNY? “That’s a possibility. If the owner or the key manager is sick/dead, it is usually the end for small organizations. If the death toll keeps rising sharply and if China’s economy takes a serious dive, many factories that could re-open might choose not to do so.”

7. How will this affect my employees on the ground? At this point, the best thing for you to do is to focus on prevention:

-

- Advise them to stay home and avoid going into public transportation, restaurants, and so on.

- Have them read this article (note that wearing a mask is far from sufficient if one wants to be safe).

- Ship some facial masks, medical gloves, and alcohol-based disinfectant to them if you can.

Renaud’s article (and only by extension my blog post) were, even in hindsight, pretty spot-on.

3. Diversifying your supply chain

My 2020 post delved deeper into the issue of moving production from Asia due to COVID. I wrote that moving production within Asia might solve some of the problems COVID will likely cause to manufacturing in China, but it might only briefly forestall them if the virus spreads to other countries in Asia as well. I also wrote that Renaud was right about how difficult it is to find a factory in Vietnam or Thailand or Indonesia with spare capacity:

Way back in October, 2018, in China or Vietnam for Product Sourcing, we were seeing clients having difficulty finding factories in Vietnam and we saw those difficulties only increasing, which they have:

China’s road and port transportation has improved since 2015, but it is still not even close to China in terms of capacity or reliability, especially for smaller companies. Vietnam has been discovered and even overrun with new manufacturing in the last few months, and this is taxing its roads and its ports and its factories. Companies that have not experienced product delays in Vietnam for years are experiencing them right now, and we expect that will only increase as more foreign companies that ship product to the United States (and even elsewhere) move production from China to Vietnam.

Thailand and Indonesia have been trailing Vietnam in lack of capacity for more manufacturing, but not by much. You are probably already too late to have your widgets made and delivered on short order from outside China, but now is the time to think about truly diversifying your production. Now is the time to truly scour the world for a new production country.

Now is the time to think outside the box by exploring and consider places such as Mexico, Colombia, Haiti, Brazil, Spain, Portugal, Poland, Nigeria, Ethiopia, Pakistan, or just about anywhere other than China, Vietnam, Thailand, Cambodia, or Indonesia for your manufacturing. This is not going to be easy but it could be what makes or breaks your company. And in so choosing, think beyond just pricing, and consider things including diversification, safety, long term stability, tariffs, duties, and intellectual property rights, too. To quote from the Sourcing Journal’s Whitepaper, Mapping the Modern Supply Chain: “While production options abound around the globe, no destination is without its potential drawbacks. Sourcing executives must weigh the pros and cons against their needs and the level of risk they’re willing to undertake. While the current trade firestorm that precipitated much of the recent movement could abate at any time, it has illustrated the need for an agile, diversified supply chain.”

In early November 2019, in How to Conduct Business with Chinese Companies That See a Dark Future, we outlined China’s many risks and we called for companies to — if possible — lessen their China exposure:

For some companies, China’s increasing risks now exceed its rewards, but for others this is not at all true. Do you really need a legal entity in China with Chinese employees or might your company be better off with no operations in China beyond a third party distributer or reseller? Our China lawyers have been doing a lot of work in the last six months helping our clients reduce their China footprint and thereby reduce their China risks. No matter what you are doing in or with China, now is a good time to look at how you too can reduce your risks.

4. Supply chain diversification has been decidedly mixed

Even before COVID — since 2018, actually — our international manufacturing lawyers have been warning companies to expect China’s relations with the West to perpetually decline and strongly pushing for manufacturing diversity. Our strongest call (and certainly our most-read and most controversial) came on May 8, 2019, with The US-China Cold War Starts Now: What You Must do to Prepare.

We have taken this same position with our clients, but few have left China for the following reasons:

1. Many expected things would improve under Biden.

2. Many have found it difficult to move manufacturing from China because of COVID.

3. Many have found it borderline-impossible to move their manufacturing from China because the costs would be so much higher for them elsewhere or because there is no elsewhere.

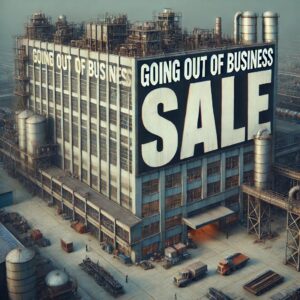

Today, virtually all of our clients would like to move at least some of their manufacturing out of China, but most of them have still not done so because of COVID or costs or just an overall inability to do so. I fear the supply chains of most of these companies and other companies that get their products from China will within a month or so be hit hard by Omicron, just as so many of them were hit hard by COVID. Many companies that manufactured in China when COVID hit have never truly recovered from it. We have clients that have gotten little or no new inventory since 2020 and are teetering on the verge of extinction.

5. Omicron will cause more manufacturing to leave China

Omicron is incredibly contagious and China is not well-equipped to slow it down to the same extent it has done with previous COVID variants. Omicron will likely lead to massive shutdowns of China’s factories and, in turn, convince more foreign product buying companies to diversify out of China.

Unlike the Pfizer and Moderna vaccines, China’s vaccines do not prevent the spread of Omicron. I repeat, China’s vaccines do not prevent Omicron infection, though they do appear to work fairly well at moderating the impact of any infection. When I tell this to clients and friends in China, their initial response is that China has never relied much on vaccines to slow COVID’s spread; it has relied mostly on testing, quarantining, and shutdowns/lockdowns. They are right and this is why I am so worried about China factory production.

Atlantic Magazine science reporter Katherine Wu (one of my go-to sources on everything COVID) yesterday came out with How Long Does Omicron Take to Make You Sick? Ms. Wu’s article was subtitled “The new variant seems to be our quickest one yet. That makes it harder to catch with the tests we have.”

The article discusses how testing will be less effective at preventing Omicron’s spread because Omicron becomes contagious much faster than previous COVID variants. By the time people test positive for Omicron, they likely will have already spread the virus to many. Ms. Wu uses a wedding in Oslo, Norway, at which 80 guests caught Omicron, as an example:

In a research paper describing the Oslo outbreak, scientists noted that, after the event, symptoms seemed to come on quickly—typically in about three days. More troubling, nearly every person who reported catching Omicron said that they were vaccinated, and had received a negative antigen-test result sometime in the two days prior to the party. It was a clue that perhaps the microbe had multiplied inside of people so briskly that rapid-test results had rapidly been rendered obsolete.

Ms. Wu then explains in considerable detail why Omicron will render tests so much less effective in slowing its spread:

The picture on Omicron is coalescing both microscopically within us and broadly in communities—steep, steep, steep slopes in growth. The two phenomena are linked: A shorter incubation period means there’s less time to pinpoint an infection before it becomes infectious. With Omicron, people who think they’ve been exposed may need to test themselves sooner, and more often, to catch a virus on the upswing. And the negative results they get might have even less longevity than they did with other variants, Melissa Miller, a clinical microbiologist at UNC, told me. Tests offer just a snapshot of the past, not a forecast of the future; a fast-replicating virus can go from not detectable to very, very detectable in a matter of hours—morning to evening, negatives may not hold.

This, especially, could be bad news for PCR tests, which have been the gold standard throughout the pandemic and essential for diagnosing the very sick. (Thankfully, most PCR tests do seem to be detecting Omicron well.) These tests have to be processed in a laboratory before they can ping back results—a process that usually takes at least a few hours but, when resources are stretched thin as they are now, can balloon to many days. In that time, Omicron could have hopped out of one person’s body and into the next, and into the next.

China’s vaccines will not slow the spread of Omicron and its tests will be rendered relatively ineffective as well. This essentially means one of two things will happen. Omicron will spread through China much as it is already doing in Africa, Europe, and the United States, or China will require lockdowns, shutdowns and quarantines to prevent that. Based on how China has reacted to COVID so far, I expect it will mandate lockdowns, shutdowns, and quarantines to try to slow Omicron’s spread. These lockdowns, shutdowns, and quarantines will close China factories and ports and lead to another massive supply chain crunch.

I fervently hope I am wrong on the above and that China and the world somehow defeat Omicron before it spreads pretty much everywhere. And even if that is not possible, I fervently hope against a new supply chain crunch. But though my heart desperately wants everything to go well, my head is telling me not to be optimistic, and certainly not to count on this. Like CNN’s Michael Smercomish, I am increasingly resigned to catching Omicron, which is something I would not have said as recently as a week ago. I am also increasingly resigned to a renewed supply chain crunch.

6. How to reduce your supply chain risks

Clients that manufacture in China have asked me what they should do right now to minimize supply chain disruptions and I tell them the following two things:

One, focus on the next 3-5 months. Do whatever you can to get as much product as fast as you can out of China, before factory and port shutdowns start impacting your supply chain. You also should monitor as best you can what is happening to your factory(s)in China because as bad as it will be to not get product from China, it will be even worse to pay for product you never get. See How to Handle China’s Rising Risks. To the extent you can get product from a country less likely to impose shutdowns and lockdowns, try to line up suppliers in those countries. Mexico, Brazil, Pakistan, the Philippines and Indonesia spring to mind. To the extent you cannot get product from a country other than China, try to line up suppliers within China in regions other than where your current factory(s) and port are located. Finding new product suppliers in the short term will be difficult or even impossible for most, but it will be possible for at least some.

Two, focus on what makes long-term sense for your supply chain. Can you keep shouldering China’s many risks? See also Has Sourcing Product From China Become TOO Risky? You should at least explore other countries for your production. It is not just non-Chinese companies that should be doing this. During the last couple of months, five Chinese manufacturing companies have reached out to my law firm for help in setting up manufacturing in Mexico.

Above all else, stay in good touch with those who know what is happening that might impact your business and be careful and be thoughtful. And make sure that being thoughtful includes the realization that it is human beings on the front lines of this crisis, wherever they may be, and the human side of all this should predominate.

What is your company going to do?