Every week we talk with international companies that are trying to bring their product or service to the U.S. market. The #1 question I get is: In which U.S. state should we set up our operations?

I always respond like this: the answer to this question depends on your goals for your business. Then I ask them a lot of questions to help them think more carefully about their U.S. business plans. Those questions usually involve most of the following:

- Why do you want to enter the U.S. market?

- What do you intend to do with your U.S. operations?

- Are you testing the U.S. market to see if it is interested in your product or service?

- Do you already have business partners in the U.S.?

- Do you have customers who want to pay a U.S. bank account?

- Do you have customers who prefer to do business with a U.S. company?

- Where are the majority of your customers?

- Do you have owners or international executives who want to live and work in the U.S.?

- Do you need key employee talent in the U.S.?

- Have you already hired employees in the U.S.?

- Are your competitors going to the U.S.?

- Do you want to keep your U.S. market entry hidden from the public view for a while?

- Do you intend to seek U.S.-based private investors?

- Do you intend to take the company public on a U.S. securities exchange at some point?

- Do you want to minimize U.S. state income taxation?

- Do you want to minimize U.S. federal income taxation?

- Are you more worried about paying U.S. taxes or having your parent company become responsible for U.S. legal issues that may arise?

- Do you currently bank with a well-known international bank with branches in the U.S.?

- Do you have an international tax adviser?

- Do you have a U.S. tax adviser?

- How much capital do you intend to invest in your U.S. operations?

- Are you interested in accessing tax credit programs or other government incentive programs?

- What is your ownership structure for your home country business operations?

- Do you need introductions to any other service providers, such as bankers, accountants, brokers, or human resources and marketing or sales consultants?

- Do you have a U.S.-facing website?

- Do you intend to accept online payments?

- How soon do you need your U.S. entity to be fully operational?

The answers to these questions often lead to additional questions, and most companies appreciate this deep inquiry into their business plans. Often they have answers for all of these questions or are looking for our firm’s input so they can answer these questions more thoroughly.

The state you choose for your U.S. operations will signal important things to the outside world. It is common for international companies to form their U.S. business entity in a different state from where they intend to do business. Often international companies will choose Delaware because they know that many companies listed on public U.S. securities exchanges are Delaware C corporations. International companies that intend to raise private funds in the U.S. or seek board or executive personnel in the U.S. will also choose Delaware.

Sometimes international companies do not want to signal to their competitors that they are thinking about entering the U.S. market. In that case they will choose a state like Delaware or Wyoming where they do not need to make public the name of the underlying owner or key board members, executives, and managers.

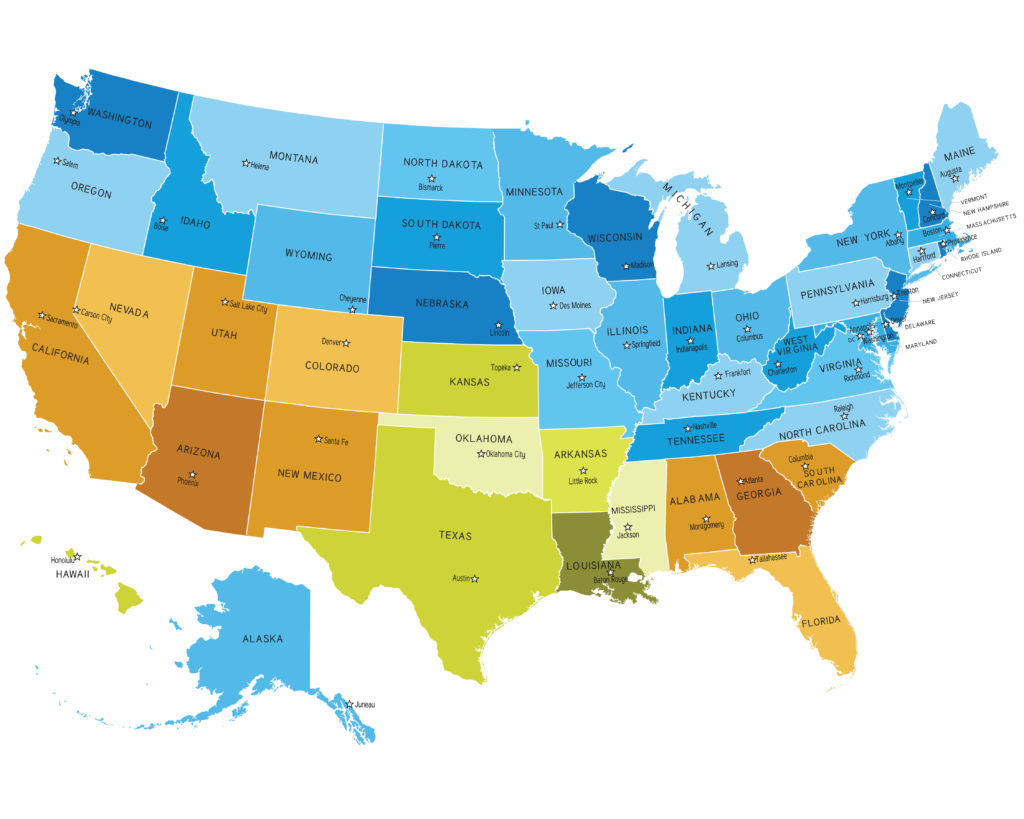

All international companies are concerned about minimizing U.S. tax obligations, so they may be interested in forming their company in Wyoming or South Dakota, the only two U.S. states (see the map here) that do not impose a corporate income tax or an equivalent tax like a gross receipts tax. Many international companies with Wyoming entities actually conduct business in other U.S. states.

Oftentimes an international company is worried about U.S. liability through lawsuits. In that case the company will set up at least one U.S. subsidiary company as a firewall against U.S. legal judgments. They often will also opt to be taxed as a U.S. C corporation because they prefer to keep all U.S. tax obligations tied to the U.S. operations rather than flowing back to the parent company in their home country.

We help companies set up business operations in China, Vietnam, the Philippines, Spain, Brazil, Mexico, and many other countries. Setting up a company in the U.S. is extremely easy and quick compared to these countries with the exception of obtaining a U.S. tax identification number (EIN) from the IRS. That can take weeks to months, so if you are thinking about setting up a U.S. company, you should get your U.S. entity formed soon so that you can get your company’s EIN and set up your bank account.

In future posts we will discuss more of the common questions we receive from international companies about setting up business operations in the U.S.