Buy America/Buy American

Navigating the legal intricacies of government contracting can be a daunting task, especially when it comes to understanding the various statutes governing domestic production and procurement. With the rise of initiatives aimed at bolstering domestic manufacturing and infrastructure, it’s imperative for government contractors to clearly discern the differences and requirements of the “Buy American Act,” “Buy America,” and the “Build America, Buy America” (BABA) provisions. This understanding is not just a matter of legal compliance; it’s integral to leveraging opportunities and avoiding significant penalties in government contracting.

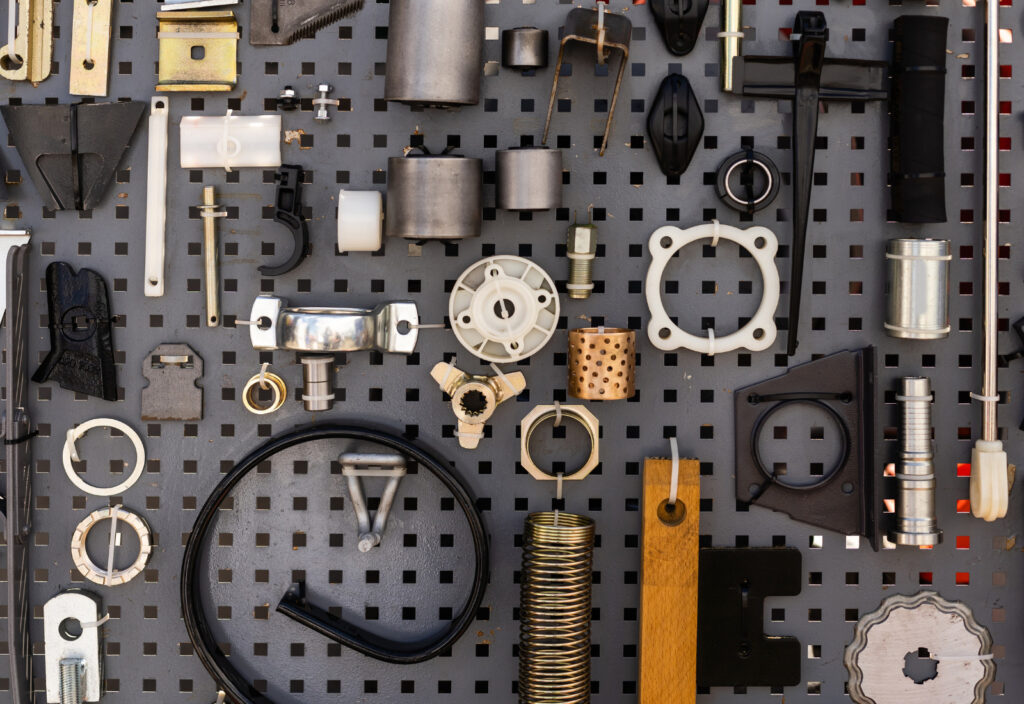

Over the past few years, I have noticed an increase in questions coming from several of my government contracting clients requesting that we assist them with compliance advice on whether various of their products are made in the USA, especially when a significant number of the parts used to produce their products are sourced from suppliers with multiple manufacturing locations outside the U.S. Having looked into this issue further, I realized that most of these questions were either the result of their engineers trying to understand better the requirements of the “Buy American Act” / “Buy America” set of statutes or their procurement departments trying to make their Buy America / American certification templates more user friendly to improve supplier response rates.

For those professionals who do not typically deal with these set of regulations in their line of work, they may not realize that there is a significant difference between the two despite the similarity in their names, the “Buy American Act” and the “Buy America” statutes are quite different. Knowing their differences can impact cost saving benefits as the penalties for failing to comply with them is severe. This post seeks to provide basic guidance on the two, and show how they impact government contractors.

How is the Buy American Act different from Buy America?

The “Buy American Act” applies only to the federal government when procuring goods. State and local governments, and private contractors on the other hand, must comply with “Buy America” statutes when working on transportation and infrastructure projects that receive federal financial assistance. These federally funded projects include projects funded through programs administered by federal agencies, including the Federal Highway Administration (“FHA”), the Federal Transit Administration (“FTA”), and etc. Further, unlike Buy America, which only applies to iron, steel, and manufactured goods used in transportation projects, two conditions must be met for the Buy American Act to apply: (1) the procurement must be intended for public use within the United States, and (2) the items to be procured or the materials from which they are manufactured must be present in the United States in sufficient and reasonably available commercial quantities of satisfactory quality. Under the above conditions, a product is considered American-made if its domestic content exceeds a threshold of 60% as of 2022. This threshold is increased to 65% in 2024, and further increased to 75% in 2029.

There are exceptions that can be granted based on minimum contract thresholds, availability, and whether the construction is temporary, depending on the regulations under consideration. One significant exception is the partial waiver to the two-part test of the Buy American Act to allows a Commercial-Off-The-Shelf (“COTS”) item to be treated as a domestic end product if they are manufactured in the U.S., without tracking the origin of the item’s components.

The “Build America, Buy America” Wrinkle

To add to the Buy American/Buy America confusion, the “Build American, Buy American” (“BABA”) provision of the 2021 Infrastructure Investment and Jobs Act (“IIJA”) is now a part of the slogan used to support domestic manufacturing. BABA not only covers Iron and steel used in activities related to the construction, alteration, maintenance, or repair of U.S. infrastructure projects supported with federal financial assistance, but it also requires all manufactured products used in the projects be produced domestically unless the requirements are waived as per Section 70914 (b) of the Act. This means that the materials must be manufactured in the U.S., and the cost of the components of the manufactured product that are mined, produced, or manufactured in the U.S. must be greater than 60 percent of the total cost of all components of the manufactured products, unless another standard for determining the minimum amount of domestic content of the manufactured product is established under applicable law.

Failing to comply with Buy American/Buy America/Build America

The consequences for failing to comply with the Buy American/Buy America/Build America prescribed requirements can range from termination from the federal procurement contract in the case of the Buy American Act, to removal of federal funding from the construction project in the case of the Buy America/BABA. In egregious cases, government contractors could potentially face criminal liability under the False Claims Act.

Conclusion

Though the “Buy American Act,” “Buy America,” and BABA provisions may sound similar, they encompass distinct requirements and implications for government contractors. It’s not just about knowing the differences; it’s about understanding how these regulations apply to your specific contracting situation. If you are a government contractor, it is vital that you understand which domestic preference rules apply to your company.