By Tom McVey & Ngosong Fonkem*

If your company is doing business with a Chinese company, it is essential to be aware of the risks associated with prohibited parties under U.S. export control and sanctions laws. The United States has strict regulations prohibiting U.S. companies from engaging with certain foreign individuals and entities. These include parties listed on the Treasury Department’s List of Specially Designated Nationals and Blocked Persons (the “SDN List”), as well as the Commerce Department’s Entity List, Denied Persons List, and Military End-User List (for certain products), among others. There are also certain restrictions on importing products from China’s Xinjiang Uyghur Autonomous Region (“XUAR”) or from parties listed on the Uyghur Forced Labor Prevention Act List (“UFLPA”). It is crucial to screen your transactions to ensure that you are not doing business with restricted parties. This is particularly important when dealing with Chinese companies, as many Chinese individuals and entities have recently been added to these lists.

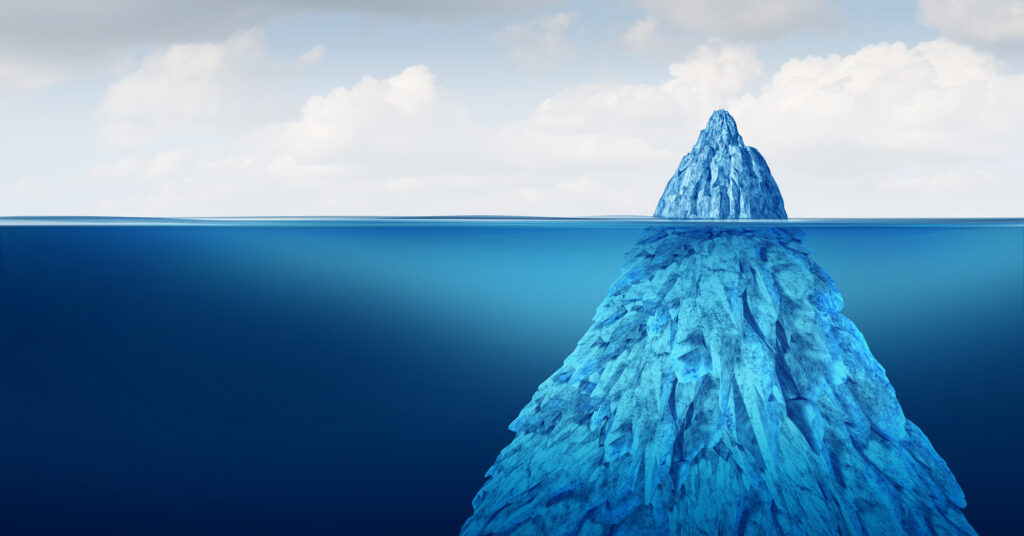

The Complexity of Screening for Prohibited Parties

Prohibited party screening involves more than just checking names on a few lists. For instance, under the Office of Foreign Assets Control’s (OFAC’s) “fifty percent rule,” if a party or parties listed on the SDN List own 50% or more of a company, that company is also considered blocked, even if it is not explicitly on the SDN List. Exporters frequently attempt to identify who the shareholders or members are in any company with which they are conducting a transaction to confirm that no party or parties on the SDN List own 50% or more of that company. Unfortunately, foreign companies often hesitate to provide accurate shareholder information, which exposes U.S. companies to compliance risks.

Similarly, the Commerce Department’s Export Administration Regulations (“EAR”) contain various restricted party lists. These lists prohibit the export or transfer of certain products to listed parties or require additional authorizations for transactions. It is the responsibility of U.S. companies to determine if the parties involved in their transactions are on these lists. See for example EAR §744.21(b)(1) which provides: “Exporters, re-exporters, and transferors are responsible for determining whether transactions with entities not listed on supplement no. 7 or 4 to this part are subject to a license requirement under paragraph (a) of this section.”

However, there are hidden complexities in these requirements. For example, the EAR’s Military End User regulation prohibits exporting certain products to “Military End Users” in China. In this section, the term “military end user” is broadly defined as “[T]he national armed services (army, navy, marine, air force, or coast guard), as well as the national guard and national police, government intelligence or reconnaissance organizations (excluding those described in § 744.22(f)(2)), or any person or entity whose actions or functions are intended to support ‘military end uses’ . . . . ” This term includes not only parties listed on the Military End-User List, but also any other party that meets the definition of “Military End User” in EAR §744.21(g), including parties whose actions or functions are intended to support “military end uses” in China.

A similar requirement exists under EAR § 744.22, which prohibits exporting all EAR-regulated products to “military-intelligence end users” or “military-intelligence end uses” in China and certain other countries. Identifying these connections can be challenging, posing significant compliance risks for U.S. exporters.

Prohibited party screening is not limited to exporters; it is also important for U.S. importers. With the implementation of the Uyghur Forced Labor Prevention Act, U.S. importers must exercise due diligence measures to comply with regulations that prohibit importing goods from entities linked to China’s XUAR region, or those listed on the UFLPA Entity List. Given the complexity of supply chains, it can be difficult to determine whether imported products involve prohibited forms of labor or are associated with listed entities, creating challenges for U.S. importers.

Penalties for non-compliance

Non-compliance with prohibited party restrictions can lead to severe penalties. Violations under the EAR and OFAC sanctions can result in fines up to $1 million and imprisonment for up to 20 per violation. Under the UFLPA, non-compliance can lead to a complete ban on imports of the product into the United States.

Due Diligence Screening Methodology

There are several steps that companies can take to attempt to reduce these risks. In addition to screening for restricted parties, companies frequently request their foreign counterparties to sign export and import compliance certifications. They can also include import and export compliance clauses in their purchase and sale contracts. These certifications can require the foreign parties to represent that they will operate in compliance with U.S. export and import laws, disclose the names of their shareholders, and confirm that none of their shareholders are listed on any relevant watchlists. Based on this information, companies can then screen the shareholder names against the SDN List and other relevant lists.

Similarly, for EAR compliance, companies can require that their foreign counterparties confirm, among other things, that they do not fall under the definition of “military end user” or “military-intelligence end user”. They should also attempt to confirm that the exported product will not be used in any “military end use” or “military-intelligence end use” as defined in the EAR. In the case of UFLPA compliance, companies can request certifications and documentation from their foreign counterparties confirming that no force labor was involved in their supply chain. This documentation may include factory visit reports, audit reports, and supply chain maps, among other things.

Since it is not uncommon for Chinese and other foreign companies to misunderstand the complex U.S. import and export requirements, U.S. companies frequently also conduct their own independent due diligence reviews of the parties involved in the transactions. Such reviews typically would examine the foreign company and its owners to gain insight into their operations and to identify any potential issues or concerns. The items to be reviewed will depend on the details of the transaction involved, but can include researching the Chinese company’s shareholders, the nature of its business activities (including any connections with Chinese military agencies or XUAR) and whether there are any reports of fraudulent, criminal or compliance violations. These independent third-party reviews help the U.S. companies fulfill their compliance obligations and help demonstrate their good faith efforts to comply with the laws. By conducting this due diligence, companies can reduce the risk of violating regulations and potentially reduce penalties. These reviews also provide valuable information about the Chinese company that can be used for business or negotiation purposes.

Conclusion

China poses unique challenges when it comes to conducting due diligence reviews, primarily due to Chinese government restrictions on information available to foreign companies and governments.

Despite these challenges, Harris Sliwoski has extensive experience conducting due diligence reviews of Chinese companies, leveraging significant resources to overcome these limitations.

When combined with other compliance practices such as restricted party screening and export/import compliance programs, due diligence reviews can serve as a valuable tool in safeguarding U.S. companies involved in Chinese business transactions.

* The above post was written by Tom McVey and Ngosong Fonkem.

Tom McVey is an international corporate attorney and business advisor in Washington, Dc. Mr. McVey advises clients on the Export Administration Regulations, the OFAC sanctions programs, ITAR, the Foreign Corrupt Practices Act, the anti-boycott laws and the Committee on Foreign Investment in the United States (CFIUS). He also advises on cross-border business transactions including international sales and distribution, joint ventures, mergers and acquisitions, private equity, international business planning and corporate compliance.

Ngosong Fonkem is an international trade attorney.