1. The New Tariffs

The Office of the U.S. Trade Representative (USTR) formally published a notice in the Federal Register (this means it is official) confirming President Trump’s by now famous weekend tweet: U.S. imports of Chinese products, valued at $200 billion, that have been subject to 10 percent tariff since September 24, 2018, will now be subject to a 25 percent tariff. The Federal Register notice itself blames China for this increase: “In the most recent negotiations, China has chosen to retreat from specific commitments agreed to in earlier rounds.” Here is the list of products now subject to a 25% tariff.

China is saying it will take “necessary countermeasures,” but it has not indicated what those measures will be nor when they will go into effect. On the one hand, China all but has to do something so as not to appear incredibly weak. But on the other hand, China knows it has a weak hand right now and it might be reluctant to do anything to further anger the United States. President Trump previously threatened to impose a 25% tariff on pretty much all goods coming from China and China could well be reluctant to retaliate for fear of Trump immediately pulling the trigger on even more tariffs in response.

Not surprisingly, our law firm’s international trade lawyers are getting a steady stream of questions from companies that import products from China and from companies from all over the world (China, Europe, Australia and Japan, mostly) that export Chinese products to the United States. These companies first want to know whether their product(s) are subject to the new 25% tariff and when that tariff will take effect. The answer to their first question depends on each company’s exact product(s). The answer to the second question is that the 25% tariff applies “to goods (i) entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on May 10, 2019, and (ii) exported to the United States on or after May 10, 2019.” In layman’s terms this 25% tariff applies to goods that left China on or after May 10.

2. Illegal Transshipping

The most important thing you can do if you believe you have been hit by the 25% tariffs is to not panic. I say this for two reasons. One, many who believe their products are subject to tariffs have been wrong and many who believe their products are not subject to tariffs have been wrong as well. Understanding whether or not a particular product is covered is not as easy as one might believe and for that reason, all of the international lawyers in my firm are turning the question of inclusion or exclusion over to our international trade lawyers because this is what they do. When various tariffs take effect can also be quite complicated. Two, we have seen panic drive too many companies to make major mistakes that end up costing them way more than the tariffs would have. So before we discuss what companies should do about their tariff problems, we will first discuss what you should NOT do. You should not have your China products shipped to Vietnam or Taiwan or Malaysia or Thailand or anywhere else and then have those products shipped to the United States claiming they are not from China. This sort of “transshipping” can and does lead to massive fines and to JAIL TIME. I am not kidding. Just by way of one example, here is a very recent case (on which my firm’s international trade lawyers assisted the US Government) where a company paid USD$62.5 million “to resolve allegations that it evaded $36 million in antidumping duties.”

We are constantly hearing of Chinese factories suggesting illegal transshipments while giving assurances that what they are proposing is legal or that nobody ever gets caught. Do not get your legal advice about United States customs law from a Chinese factory owner or salesperson trying to convince you to buy product from them. Please.

US Customs has become expert at discovering such evasions and the penalties when caught have become very harsh. Importers that knowingly falsely label the country of origin on their imports are subject to significant fines and penalties under 19 USC 1592 and to criminal prosecution under 18 USC 542 (import by using false statement) and 18 USC 545 (smuggling). Lying about your products’ country of origin can subject you to 20 years in Federal prison.

U.S. Immigration and Customs Enforcement (“ICE”) has conducted criminal investigations against a number of products, including honey, saccharin, citric acid, lined paper products, pasta, polyethylene bags, shrimp, catfish, crayfish, garlic, steel, magnesium, pencils, wooden bedroom furniture, wire clothing hangers, ball bearings and nails. U.S. importers have been sentenced to prison for bringing in Chinese products, such as honey, garlic, wooden bedroom furniture and wire clothing hangers, with false Country of Origin statements. Whenever the US increases tariffs on a product, it knows there is an increased likelihood of illegal transshipping of that product and it prepares accordingly. If you do not realize the U.S. government would like nothing more right now than to catch and punish those who transship China products to avoid the new China tariffs, you have not been reading the news. The U.S. government (and even the U.S. populace as a whole) are eager to act harshly against anyone who engages in transshipping Chinese products.

One of the biggest hammers against transshipping is the False Claims Act (“FCA”). The FCA ( 31 U.S.C. § 3729) allows people or companies to bring “qui tam” lawsuits against individuals or companies that defraud the Federal government. Damages under these claims can be tripled and anyone who knows of the fraud (including a competitor company) may file a qui tam lawsuit.

Qui tam actions are brought to attack competitors and to get 15 to 30 percent of the triple damages the U.S. Government can recover from the lawsuit. Your competitors and your importers and your own employees (and even employees of the Chinese company that assured you that your transshipping is perfectly legal) are the most likely to initiate a qui tam lawsuit against you, but sometimes it is just someone who learned of what you are doing. Because the person or company that brings such an action can be awarded millions of dollars the incentive to file such lawsuits is huge.

3. U.S. Importer Responsibilities

What is your duty as the US buyer/importer to make sure the products you are importing are truly from the country listed on the import documents?

The examples below are illustrative.

- A US importer is told by its Chinese producer/exporter whose products will be covered by the China tariffs not to worry about the tariffs because the Chinese company will ship the product through Taiwan and list them as Taiwan products. The importer should decline this offer because if it imports this product knowing it is from China and not Taiwan, it will be criminally liable under U.S. customs law and subject to potentially massive damages under the U.S. False Claims Act.

- A US importer suspects its Vietnamese “producer” is not actually making anything, but rather simply transshipping product that comes from the Chinese company that owns the Vietnamese “producer” company. The company visits the Vietnam “producer” facility and it does not appear anything is actually being produced there. The US importer raises this concern with the Chinese company which tells the US company that it can avoid any problems by being listed as the consignee of the products and not the importer of record since it is the importer who is at risk. This too is simply wrong information.

Fraudulent transshipment is a crime and Chinese companies and their US importers can have very different interests when it comes to importing product into the United States. The Chinese company wants to ship product to the US above all else and the US importer should above all else want to avoid trouble with U.S. Customs and avoid liability and stay out of jail.

If you are doing business with a person or company using transshipments to minimize US customs duties, you could be in very big trouble and you should contact a lawyer immediately. If you are aware of such transshipments by a company with which you are not doing business, you should consider contacting a lawyer to determine how you can profit from your information.

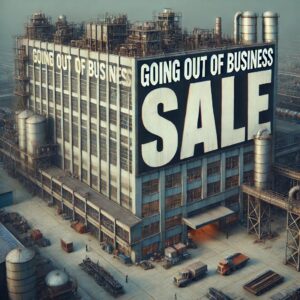

4. How to Fight Against the Tariffs

Now let’s turn to what you can do to fight back against the U.S. tariffs being imposed on goods coming in from China.

There is often a lot you can do to legally change your products’ country of origin. The rules for figuring out a product’s appropriate country of origin are incredibly complicated and best left to experienced and qualified international trade lawyers, especially with all that is going on between China and the United States these days. Even our China lawyers do not claim to be qualified on this score; I tell my clients who ask for country of origin help something like the following:

Putting together your electronics product in China and then shipping it to Vietnam for a plastic case to be put on will not qualify that product as having been made in Vietnam. That much I do know. Beyond this though, you are going to need to consult with our trade and customs lawyers because this is not something you can afford to get wrong.

So yes, it may be possible for you to make minor (or major) changes in how you are having your products made so they can legally avoid the China tariffs, but you truly must tread carefully here and whatever you do, do not just go along with what your China factory is telling you to do. It is your company and your money and your freedom at stake and this is not something on which you should be taking advice from anyone but an expert who is looking out for your interests.

One of the questions we ask our clients is what will happen to your product sales if your products from China are subject to a 25% tariff and your competitors’ products are not? Answering this question requires knowing whether your products or your competitors’ products will come in duty free from Thailand or be subject to a 7% duty (or whatever) from Vietnam. I mention this because generally (though certainly not always) duties from Thailand and the Philippines are lower than duties from Vietnam, so even in choosing which non-China country you are going to use for your manufacturing, you need to know your way around the duty charts.

If you are going to take your Made in China products and have them partially made in some third country so as to have that product qualify as having been made in that third country (and not China) that product will need to be “substantially transformed” in that third country. One of my law firm’s international trade lawyers describes the substantial transformation requirement as follows:

Substantial transformation dictates that a product consisting of components/materials from more than one country is a product of the country where the components/materials become a new and different article of commerce with a name, character, and use distinct from that of the components/materials from which it was transformed. The CBP makes its substantial transformation decisions on a case-by-case basis, though U.S. importers may seek advance rulings on origin covering specific products for import.

The rules on substantial transformation are anything but clear-cut and the country of origin for your products should be determined on a case-by-case basis by a qualified international trade lawyer.

You also may be able to secure an exemption from tariffs for your product(s), just as was true regarding the previous rounds of tariffs. The exact process for how to do this and the corresponding deadlines have not yet been announced but we expect both will be very similar to the previous tariff rounds and our international trade lawyers are already gathering information from clients so as to be prepared.

You also will be able to make what is called an exclusion request. These too will have their deadline dates and these exclusion requests typically include the following:

1. Identify the product you want excluded. The U.S. list of targeted products is identified by the Harmonized Tariff Schedule (HTS) number that is used to declare the product when imported into the United States. A company needs to identify the commercial name of the product, the HTS number for the product, and any other industry designation of the product under a recognized standard or certification (for example: ASTM, DIN).

2. A description of the product based on physical characteristics (for example: chemical composition, metallurgical properties, dimensions) so your product can be distinguished from other products that would still be covered by the tariffs. A significant concern in considering exclusion requests is whether granting a specific exclusion request will create a loophole many other products can also use.

3. The basis for requesting an exclusion. Is the product unavailable from a domestic U.S. supplier and thus imports are needed to fill a demand no U.S. supplier can fill? Are there certain qualification requirements only the import supplier can satisfy? Have you been put on allocation by domestic suppliers? Are there alternative suppliers in any country other than China?

4. The names and locations of any producers of the product in the United States and in foreign countries.

5. Total U.S. consumption of the product by quantity and value for each year for the past three to five years (2013 – 2017) and projected annual consumption for the next few years (2018- 2020), with an explanation of the basis for the projection.

6. Total U.S. production of the product (or possible substitutes) for each of the past three to five years.

7. Discussion of why the U.S. products (or substitute products) cannot be used in place of the imported products.

8. A good story why your company deserves the exclusion it is requesting. This typically includes the history of your company (e.g., fifth generation family-owned), the products produced by your company, the strategic significance of your company’s products, the number of workers in your company, and your company’s annual sales.

The difference between the exemption process and the exclusion process is that a successful exemption will lead to the removal of tariff line items from the tariff list whereas a successful exclusion will remove specific products from the tariff item. In other words, the requirements for the exclusion process are much more product specific; if you have five different types of widgets, you will have to make six different product exclusion requests.

A new round of 25% tariffs are here and more may be coming. Now is the time to figure out what to do to ameliorate their impact on your business.