On March 3, the Oregon legislative short session ended. Our representatives covered quite a lot in just 35 days, including the passage of four good marijuana bills and one great hemp bill. Governor Kate Brown signed two of the marijuana bills yesterday, March 7, and the others should be endorsed shortly. Because each new bill “declares an emergency,” each takes immediate effect.

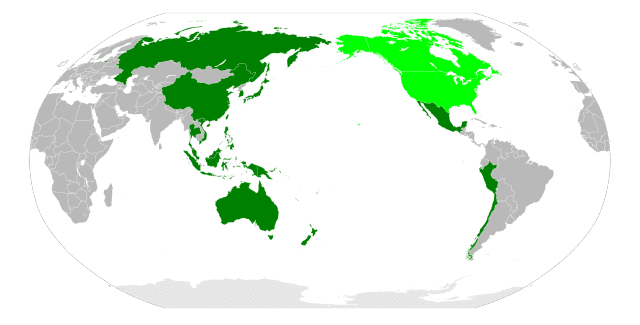

This blog post will be the first in a four-part series that takes a close look at the new laws and attempts to hit the high notes on each. Today’s post covers HB 4014, an omnibus bill that changes the game in a big way by abolishing residency requirements for Oregon’s recreational pot program. HB 4014 was signed into law yesterday, and we couldn’t be more pleased.

If you have been anywhere near Oregon’s nascent recreational program, you will recall that the state required each pot business to be controlled by a two-year Oregon resident, and at least 51% Oregon owned. To read about the headaches those rules caused, see our previous posts. Alongside legal challenges, many of our Oregon clients were screened from much needed capital, especially without access to commercial lending. Non-resident clients were frustrated at the barriers to entry (which may have been unconstitutional).

In addition to repealing the recreational program’s residency requirements, HB 4014 provides that these requirements no longer apply to Oregon Medical Marijuana Program (OMMP) growers, processors, or retailers. The residency requirement for patients, however, still applies. OMMP growers may now enter into personal agreements to provide marijuana to multiple program cardholders based on existing plant counts. The cost of a medical card for veterans has been reduced to $20.

In other news, HB 4014 shields sensitive information from public disclosure. Under the new regime, the address of a proposed OLCC licensed premises, its security plan and operational plan all are exempt from public disclosure. Also exempt is “any record that [OLCC] determines contains proprietary information of a person who holds a license…”. This is a boon for safety and business information safekeeping. It’s also a boon for cannabis lawyers who will no longer have to shrug and feel bad when clients ask how this information can be protected.

HB 4014 also contains a new section on medical marijuana businesses applying for OLCC licensure. The new law instructs the OLCC to adopt rules for the transition of growers, grow sites and dispensaries into the recreational program, and to adopt procedures to transition inventory into the recreational program. To assist both medical and recreational operators, HB 4014 expressly allows everyone to deduct business expenses allowable under section 280E of the Internal Revenue Code when filing a state tax return. Given the oppressive tax regime faced by marijuana businesses, this is welcome news.

Finally, HB 4014 tamps down some criminal penalties for cannabis offenses and creates a pilot program to reduce pot use by youngsters; it allows the state to enter into agreements with federally recognized Indian tribes related to marijuana activities on tribal lands; it prohibits retailers from bundling free or discounted marijuana items with sales of other items; and it creates a couple of work groups.

In all, HB 4014 accomplished almost everything it set out to do (except for maybe smoking lounges), and it is encouraging for industry players to see the state working hard in response to industry feedback. Oregon’s marijuana programs are now wide open for entrepreneurs and investors, and the state is positioned to succeed. Check back soon for a rundown of the other big bill that passed this session, SB 1511.